This will never work (Vol. 6, No. 27)

Good things come to those who wait…or maybe not

Our long-time readers know how we feel about “structured products”. We hate that we always lose money on them but we love how crafty they are.

We have spilled a lot of ink on Fixed Coupon Notes (FCNs – see here, here, here and here). For this post, we turn to a different beast – the Dispersion Warrant. We first came across this frankenstein three years ago during the pandemic. Despite everyone being locked down and the absence of vaccines, the stock market dismissed these fears and surged to new all-time highs.

Should investors chase or take profits? Without a clear sense of direction, the private banks’ pitch was to enhance client portfolio with a less market dependent strategy.

The idea was to pick 10 stocks across different thematics. Over the course of a cycle (say three years), their performance would diverge. As long as there is dispersion in performance, you win.

But in order to get Mr. and Mrs. Wong to place their bets, a simple “less market dependent strategy” is not good enough, another key ingredient is levered return. In this case, in exchange for a measly 5.5% premium, the investor gets the average of the absolute spread less the strike.

For instance, during the backtest period, the two baskets that they picked had average dispersion of 116% and 106%. Net of the warrant’s strike level, they paid 68% and 42%, allowing the client to capture a 12.4x and 7.7x payoff regardless of where the market was headed…

Given our history with “structured products”, we wondered how they would trick us this time. Perhaps due to recency bias, we thought the catch would be in a market reset event, like Covid, where a depressed base would make dispersions tighter but the math did not bear out this concern. Upon closer inspection, the “catch” was obvious. The two baskets both contained one outlier, a multi-bagger which rose 6x during the back-testing period.

Are we too sceptical? Maybe this time it’s different. In order to test our hypothesis, we needed time, lots of time, three years to be exact.

A Few Moments Later…

This past Monday marked the “Final Valuation Date” for the dispersion warrant. Did the themes play out as expected? Did investors make money on the dispersion warrants?

New Vs. Old Economy – Wrong Way Around

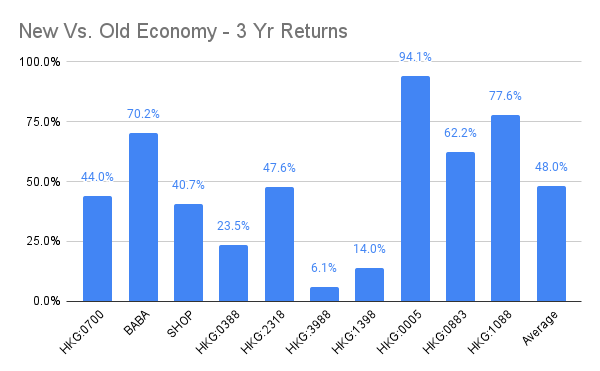

The HK-China dispersion warrant was structured along the New Vs. Old Economy theme. Back in September 2020, Chinese tech stocks were so hot that Hang Seng Index Company decided it needed a TECH only index. While the private banks may have originally pitched the warrant as a way to play tech’s continued outperformance, the dispersion was actually the other way around. Over the past three years, the New Economy names fell -39-68% while Old Economy banks and energy producers gained +64-96%.

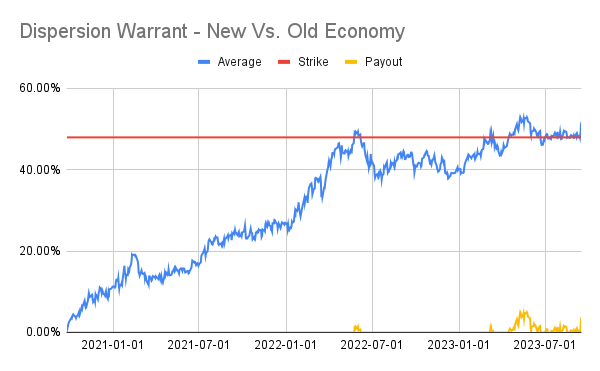

With the new economy’s losses offsetting the old economy’s gains, the average performance was only 2.2%. Superficially, this is a good set up for the dispersion warrant with the absolute spread coming out to 48.0%.

The trouble is, the private banks are much smarter than us. When they structured the product, they had already considered the various stock’s volatility and set the strike at 47.95%, resulting in a net payoff of 0.05%.

Although the New-Old Economy dispersion warrant expired almost worthless, it did temporarily trade in the money. At its most volatile point, the average dispersion reached 52.92%, putting the warrant 4.97% in the money. Theoretically, the warrant could have been set off to take profit but practically the chance of doing this is zero. Firstly, having been underwater for so long, who would cash in a gain which is less than the premium involved (5.5%). Secondly, since the warrant’s set off would involve the issuer, once all the time value, decay, theta, gamma are considered, the actual payout would be much smaller than our simplistic calculation.

US Elections Dispersion warrant

The US dispersion warrant was pitched as a play on the 2020 US Elections. It included some healthcare stocks, some wireless carriers and a bunch of other names. There was probably some logic behind the basket but we struggle to see how they play on the 2020 US elections.

Fast forward to today and there was little dispersion in their returns. The wireless carriers, AT&T and Verizon, are the only two that dropped. The other eight have all gone up by 3-35% (except KSU which was acquired by CP).

At the final fixing date, the average dispersion was only 24%, putting the US Election Dispersion Warrant 18ppt below its 42.4% strike. Compared to the New-Old Economy dispersion warrant, the US version was never in the money.

Although a 5.5% premium is not much money and certainly better than losing 99.9% on a China HY bond, let’s not kid ourselves that dispersion warrants are good for enhancing portfolio returns. They are just an expensive lottery ticket.

Like this coming Thursday Mid-Autumn Festival Mark Six Snowball (our lottery), the biggest enhancement is to the House’s return. At least with Mark Six, most of the proceeds go towards local charities.

Happy Mid-Autumn Festival!